Financing

Among the Chinese AI firms raising new funding, Deep Intelligent Pharma has bagged a total of $110m in two rounds of funding since last December, while Levinthal, OxTium and Aureka have also closed new investment rounds.

Cell and gene therapy is shifting into a new phase, as maturing commercial launches, rising big pharma participation and regulatory momentum replace hype and skepticism.

PharmAbcine founder shares views on current lack of post-delisting protections for technology companies in South Korea, proposing special regulations to safeguard expertise and assets for a certain period.

Both companies announced that during special meetings on Jan. 29, their shareholders voted nearly unanimous support for Kimberly-Clark’s $48.7bn acquisition proposed in November at $3.50 per share plus 0.14625 share for each Kenvue share.

Multiple Chinese biotechs are seeking to raise new funds through IPOs on the Hong Kong and Beijing stock exchanges to support international clinical trials for their first-in-class molecules.

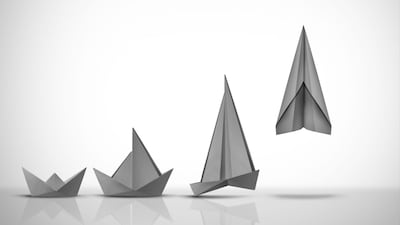

Fund IV exclusively targets company creation and early-stage investing across the UK and the US.

EIT Health has helped 3,000 start-ups and SMEs scale across Europe and supported over 120 innovations to launch. Inspired by the US MIT, the EIT Health program is on a mission to raise awareness of its value to healthtech innovators as it embarks on new methods of funding its own activities.

With needed funds in its pocket, Biocon is prepared to simplify and integrate its growing off-patent medicines portfolio under one roof.

It’s time for In Vivo's 18th annual Deals of the Year contest. We've chosen 15 nominees across three categories – Top M&A, Top Alliance, and Top Financing – and now it’s your turn to pick the winners.

Thirteen $1bn+ alliances were penned in December, and three exceeded $2bn. In the top alliance by deal value, OTR Therapeutics and Zealand Pharma entered a potential $2.5bn multi-program agreement in which the partners will co-discover and co-develop innovative therapies for metabolic diseases.

An interactive look at pharma, medtech and diagnostics deals made during December 2025. Data courtesy of Biomedtracker.

AI-related deal activity in the fourth quarter of 2025 brought a broad mix of financing rounds, acquisitions and strategic collaborations.