Deal-Making

The antibody-drug conjugate pipeline has more than doubled to 895 candidates since 2023, with DNA topoisomerase I overtaking HER2 as the dominant target.

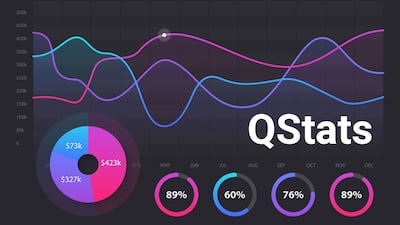

During Q4, biopharmas brought in an aggregate $30bn in financing and device company fundraising totaled $9.7bn; while in vitro diagnostic firms and research tools players raised $1.5bn.

It’s time for In Vivo's 18th annual Deals of the Year contest. We've chosen 15 nominees across three categories – Top M&A, Top Alliance, and Top Financing – and now it’s your turn to pick the winners.

Thirteen $1bn+ alliances were penned in December, and three exceeded $2bn. In the top alliance by deal value, OTR Therapeutics and Zealand Pharma entered a potential $2.5bn multi-program agreement in which the partners will co-discover and co-develop innovative therapies for metabolic diseases.

An interactive look at pharma, medtech and diagnostics deals made during December 2025. Data courtesy of Biomedtracker.

Gero AI has secured major pharma partnerships in aging space despite raising only $17M, punching well above its weight class.

An interactive look at pharma, medtech and diagnostics deals made during November 2025. Data courtesy of Biomedtracker.

Investors and analysts say cell and gene therapy is entering a disciplined “phoenix” phase, with selective risk taking, AI enabled platforms and new pricing models redefining how one time cures attract capital.

Four $1bn+ alliances were penned in November, and three exceeded $2bn. In the top alliance by deal value, Valo Health entered into a potential $3bn collaboration with Merck KGaA to advance therapeutic discovery in Parkinson’s disease and related disorders.

A pair of private equity mega-deals dominated the mergers and acquisitions landscape in 2025, but there was still a clear appetite for smaller, strategic takeovers and tuck-ins across the generics, biosimilars, and off-patent medicines field.

Beyond the fierce Lilly and Novo Nordisk competition in the weight-management market, other deep-pocketed firms are advancing their novel candidates and seeking a way in through dealmaking.

As regulatory uncertainty under the Trump administration eases, with dealmaking picking up and biopharma firms delivering good data, financial markets are primed for biopharma investment.

Eleven $1bn+ alliances were penned in October, and four exceeded $2bn. In the top alliance by deal value, Innovent Biologics entered into a potential $11.4bn collaboration with Takeda to co-develop and commercialize next-generation immuno-oncology and antibody-drug conjugate cancer therapies.

An interactive look at pharma, medtech and diagnostics deals made during October 2025. Data courtesy of Biomedtracker.

During Q3, biopharma merger and acquisition deal value reached $40.7bn and drew in $66.5bn in potential deal value from alliances. Device company M&A values reached $6.4bn, while in vitro diagnostics and research tools players’ M&A activity totaled $15m.

Launched in April 2025, Astellas’s Innovation Lab unites fragmented research units under Morten Sogaard to pursue focused indications, a dual-track R&D strategy and tailored partnerships that balance innovation, risk and collaboration.

Corporate venture arms can be powerful growth partners, but founders who don’t take time to understand them risk missing their greatest value.

Pharma business development teams are adapting M&A and licensing strategies amid market volatility and looming patent cliffs.

During Q3, biopharmas brought in an aggregate $20.1bn in financing and device company fundraising totaled $2.5bn; while in vitro diagnostic firms and research tools players raised $1.2bn.

The neuromodulation space is quickly filling with well-funded companies that have demonstrated early signs of success. However, with strategics seemingly unwilling to spend on novel technologies and pharma desperate to maintain its foothold in CNS, these companies will face many challenges.