Market Intelligence

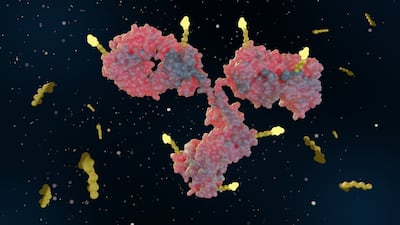

The antibody-drug conjugate pipeline has more than doubled to 895 candidates since 2023, with DNA topoisomerase I overtaking HER2 as the dominant target.

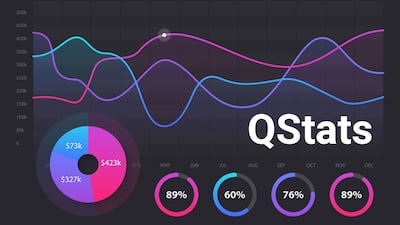

During Q4, biopharmas brought in an aggregate $30bn in financing and device company fundraising totaled $9.7bn; while in vitro diagnostic firms and research tools players raised $1.5bn.

Cell and gene therapy is shifting into a new phase, as maturing commercial launches, rising big pharma participation and regulatory momentum replace hype and skepticism.

The medtech industry has been disrupted by tariffs and China’s volume-based procurement policies. While India is expected to emerge as a key long-term growth market, near-term upside may come from a potential rebound in EU attractiveness following the MDR reform proposals in December 2025.

Biogen’s head of development reflects on transforming company strategy, surviving the Aduhelm crisis and building sustainable growth through disciplined portfolio management.

It’s time for In Vivo's 18th annual Deals of the Year contest. We've chosen 15 nominees across three categories – Top M&A, Top Alliance, and Top Financing – and now it’s your turn to pick the winners.

Thirteen $1bn+ alliances were penned in December, and three exceeded $2bn. In the top alliance by deal value, OTR Therapeutics and Zealand Pharma entered a potential $2.5bn multi-program agreement in which the partners will co-discover and co-develop innovative therapies for metabolic diseases.

AI-related deal activity in the fourth quarter of 2025 brought a broad mix of financing rounds, acquisitions and strategic collaborations.

A search bar has become one of the most powerful gateways into modern healthcare. The result is a gray zone where advertising practices, consumer trust and public health collide, raising questions about whether digital marketing has outpaced regulation.

Investor enthusiasm for exciting data in 2025 transformed the prospects of a few companies in a single day’s trading – but that enthusiasm sometimes disappeared almost as quickly as it arrived.

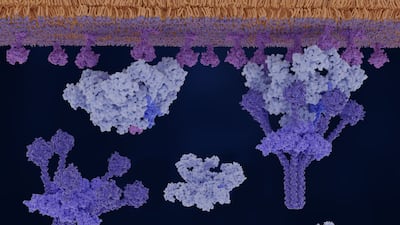

Alexion is leveraging long standing C5 leadership to expand into proximal complement targets and alternative pathway drugs, pairing longer acting and subcutaneous options with genetically guided precision medicines.

Gero AI has secured major pharma partnerships in aging space despite raising only $17M, punching well above its weight class.

Executives at the cell and gene therapy accelerator ElevateBio point to clinical impact, expanding toolbox and manufacturing improvements as reasons for optimism.

Industry warns healthcare infrastructure – not manufacturing – may be the real bottleneck as cell therapies eye mass-market diseases.

Investors and analysts say cell and gene therapy is entering a disciplined “phoenix” phase, with selective risk taking, AI enabled platforms and new pricing models redefining how one time cures attract capital.

Four $1bn+ alliances were penned in November, and three exceeded $2bn. In the top alliance by deal value, Valo Health entered into a potential $3bn collaboration with Merck KGaA to advance therapeutic discovery in Parkinson’s disease and related disorders.

With two late-stage lupus assets finishing recruitment and a newly acquired nephrology franchise running three concurrent Phase III programs, Biogen is making its most significant commitment yet to immunology beyond its legacy MS business.

Two leading German generics and biosimilars giants are the big movers at the top of our annual ranking of off-patent industry leaders. We reveal the latest developments in this year’s Generics Bulletin Top 50.

In this episode of the In Vivo podcast, Kairos Pharma's chief scientific officer discusses developing therapies to reverse drug resistance in oncology, with ENV-105 showing promising Phase II results in resensitizing hormone-resistant prostate cancer.

The biopharmaceutical landscape in 2026 will be shaped by rapid technological progress, shifting geographic leadership, a looming patent cliff and a renewed focus on capital efficiency.